Lazy Review: Is the MaxRewards App Worth It?

Tl;dr: MaxRewards is too glitchy to justify its surprisingly high cost, but it has some useful features.

This is a Lazy Review 🦥—where I try a product and see if I can get value from it without headache or hassle. For my first test, I tried MaxRewards, an app that tracks and maximizes your credit card rewards and perks.

I first heard about MaxRewards through a sponsored email claiming it was the best way to manage your credit cards. Unfortunately, my review had to be a little lazy. The free trial lasts just seven days before you’re asked to pay for a full year. MaxRewards lets you set your own price, but only up to a point—the cheapest option is $54 (about $9/month). So this review reflects one week of testing before I pulled the plug.

Still, a week was enough to get a sense of both the app’s potential and its frustrations. While MaxRewards offers some genuinely valuable features, I found it too glitchy and too expensive to recommend—though it might still appeal to the right person.

What is MaxRewards?

MaxRewards aims to eliminate several credit-card headaches in one app, like figuring out which card to use, tracking quarterly bonuses, and remembering to activate merchant offers.

Which card is best? By tracking the earning rates across different cards (the number of points, miles, or cents back per dollar spent) and the value of those rewards, you can use MaxRewards to quickly figure out which card is best in any given situation to maximize your rewards. In a restaurant and confused about how to compare cards earning 7x Hilton points vs 3x Amex points vs 2x AA miles? MaxRewards can point you in the right direction.

Don’t forget to click. You can save money or earn extra rewards with benefits like card-linked merchant offers or quarterly bonus categories like those on the Discover It. But these benefits don’t apply automatically, you have to go into the app and manually activate them. That is, unless you have MaxRewards, which will do that automatically for you.

Search and save merchant offers. If you’re standing in the checkout line and want to know if you can use a credit card merchant offer to save money, MaxRewards keeps them all in one place so you can easily search to see if you have one for a specific merchant and what cards have those offers. You can even “favorite” offers to flag them for later.

Track your benefits. With many cards offering statement credits as a way to claw back your annual fee, it’s important to make sure you take full advantage of them each month. MaxRewards lets you consolidate them all in one place, verify whether you’ve used them, and can even send you notifications to alert you when they are about to expire. MaxRewards also offers a spending tracker to show your progress toward welcome bonuses.

Spending dashboard. MaxRewards offers a centralized place to see your overall credit card spending, with category breakdowns and analysis of your reward earning rates. MaxRewards also tracks your recurring charges, which might flag some monthly charges you might have forgotten about.

MaxRewards’ Best Features

So, how well does all of that actually work in practice? Not everything worked quite as advertised for me, but MaxRewards did have plenty to appreciate.

The main dashboard offers a wealth of information on things like balances, credit utilization, rewards earning—even your credit scores, if you have credit cards that provide those to you. This is especially great if you have multiple cards with multiple banks, as you can see overall spending all in one place. This is the main reason I would consider paying for this app.

The welcome bonus tracker is a great backup if your bank doesn’t offer one.

You can add custom values on your points. This is really helpful in comparing different cards with different earn rates on different points. You’ll need to have a sense of what different points are “worth” to you, but MaxRewards has a somewhat reasonable default or you can plug in a set of values from someplace like NerdWallet until you develop your own values. This means, for example, if you value Bilt points at 1.25¢ each but Hilton points at 0.5¢ each, you can set those values and MaxRewards will tell you to use your Bilt Card at local restaurant (3x points per dollar, 3.75¢ in value) rather than the Hilton Surpass (6x points per dollar, 3¢ in value).

In short, the data-rich dashboard and custom valuations are the main reasons to give MaxRewards a try.

Where MaxRewards Falls Short

Despite the app’s promise, MaxRewards often falls short in the execution. In my experience:

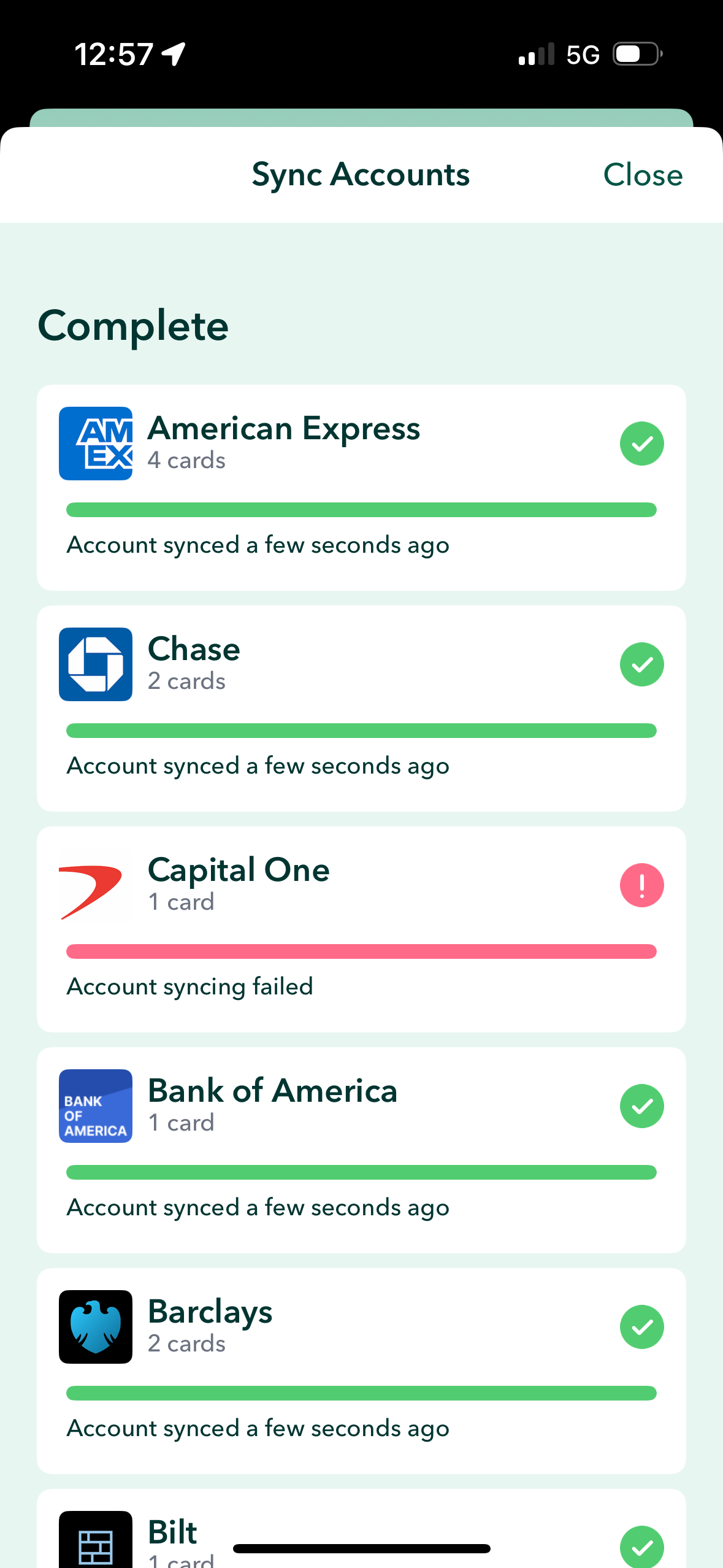

Syncing often failed on at least one card

My Amex offers weren’t activated

You can’t search merchants by brand, only location, so if you want to know if you have a bonus at, say, Nike, it’s frustratingly difficult to quickly look that up

MaxRewards frequently failed to track credits, saying I hadn’t used statement credits that I actually had.

The welcome bonus tracker had incorrect spending data.

It had incorrect information on certain cards, for instance showing a 1x earn rate on dining on my Atmos Summit rather than the correct 3x

It omits certain rewards like the 10% BoA account bonus on the Atmos Summit or SimplyMiles bonuses

Unfortunately, these glitches undermine the app’s main purpose: saving time and effort.

Ironically, I also didn’t love its headline feature: automatic offer activation (but that’s not the app’s fault). I prefer to activate offers manually, so that I can know when I have opportunities to save or earn extra rewards. This requires more attention and risks temptation toward extra spending, but I’ve come to prefer identifying merchants that I shop with frequently that have offers, since I can time my purchases to maximize rewards.

Alternatives to MaxRewards

If you’d rather spend $0, there are free ways to get many of the same benefits:

CardPointers has a free browser extension to add all your merchant offers at once

Spreadsheets work fine for tracking merchant offers and statement credits

Most banks already track welcome-bonus progress

You can also just sum up your payments made and current balance in a spreadsheet to ballpark your welcome bonus progress

Lazy Take 🦥

I was underwhelmed by my brief free trial of MaxRewards. Even if it had worked as intended (which it didn’t), I don’t think it was worth $9 per month just to save a few minutes tracking merchant offers and credit card benefits myself.

That said, if you want a single dashboard for all your cards and prefer automatic offer activations, MaxRewards could still be worth testing yourself.

You can try it using my referral link with code 7f932801-d. (FYI: we may earn rewards on referrals; thanks for your support!) You might also get a free month of Gold with a referral, but I’m not sure if that offer is still current.

Final thought: Good idea, poor execution. Try the free trial before you pay.

Want more lazy product reviews like this one? Subscribe to LazyPoints Weekly, our free every Sunday morning newsletter, with quick hits (I can be even lazier!) on credit card news, travel deals, and low-effort ways to earn more points.