Save with Merchant Offers

Tl;dr: Merchant offers contain great deals on things like travel, dining, and shopping. You can use Cardpointers to add them all and save without the temptation to spend.

The best credit cards are valuable not only for the points they earn or perks they offer, but also for the incentives merchants sometimes offer through them. In 2023, I saved roughly $600 by taking advantage of merchant offers on things like gas, dining, and travel. I personally seek out the best deals across multiple cards, but you can also rely on a single card and activate all the the offers with a tool like Cardpointers for automatic savings.

How do merchant offers work, and what kind of deals are available?

When you log into your Amex, Chase, Citi, or SimplyMiles (an American Airlines-specific version tied to linked MasterCard accounts) account, you will see offers from various merchants with an incentive for spending a certain amount with them. All you have to do is click on them to “activate” the offer; you’ll receive the incentive when the qualifying charge appears on your statement.

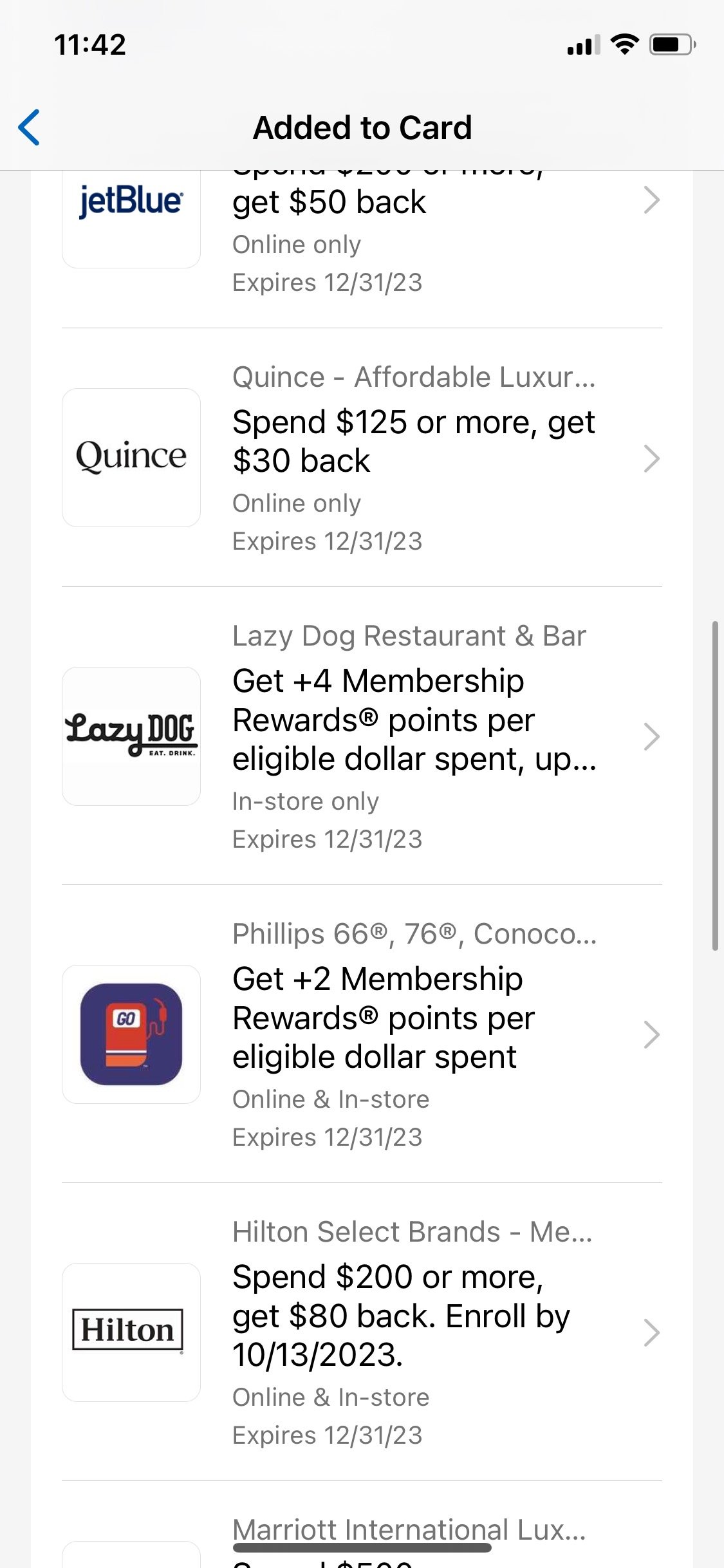

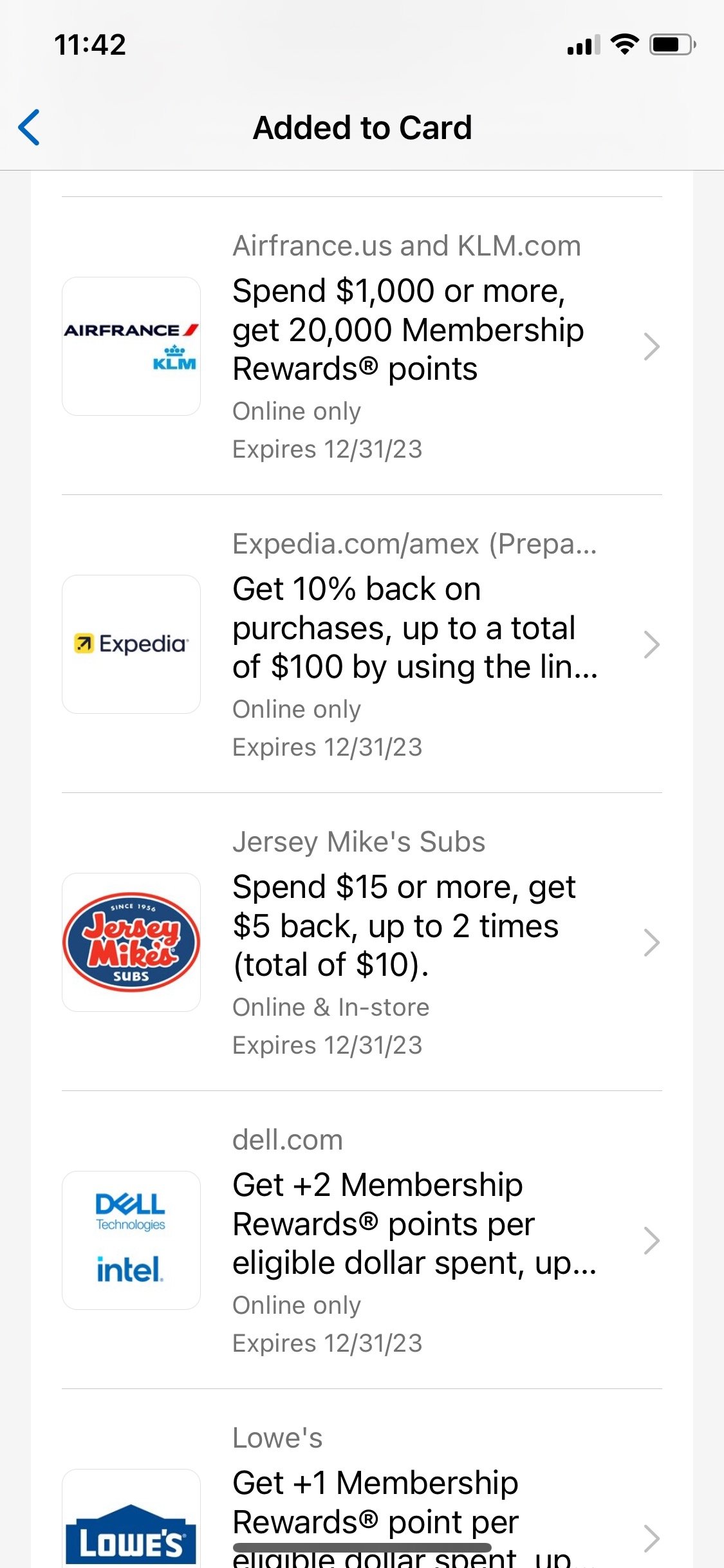

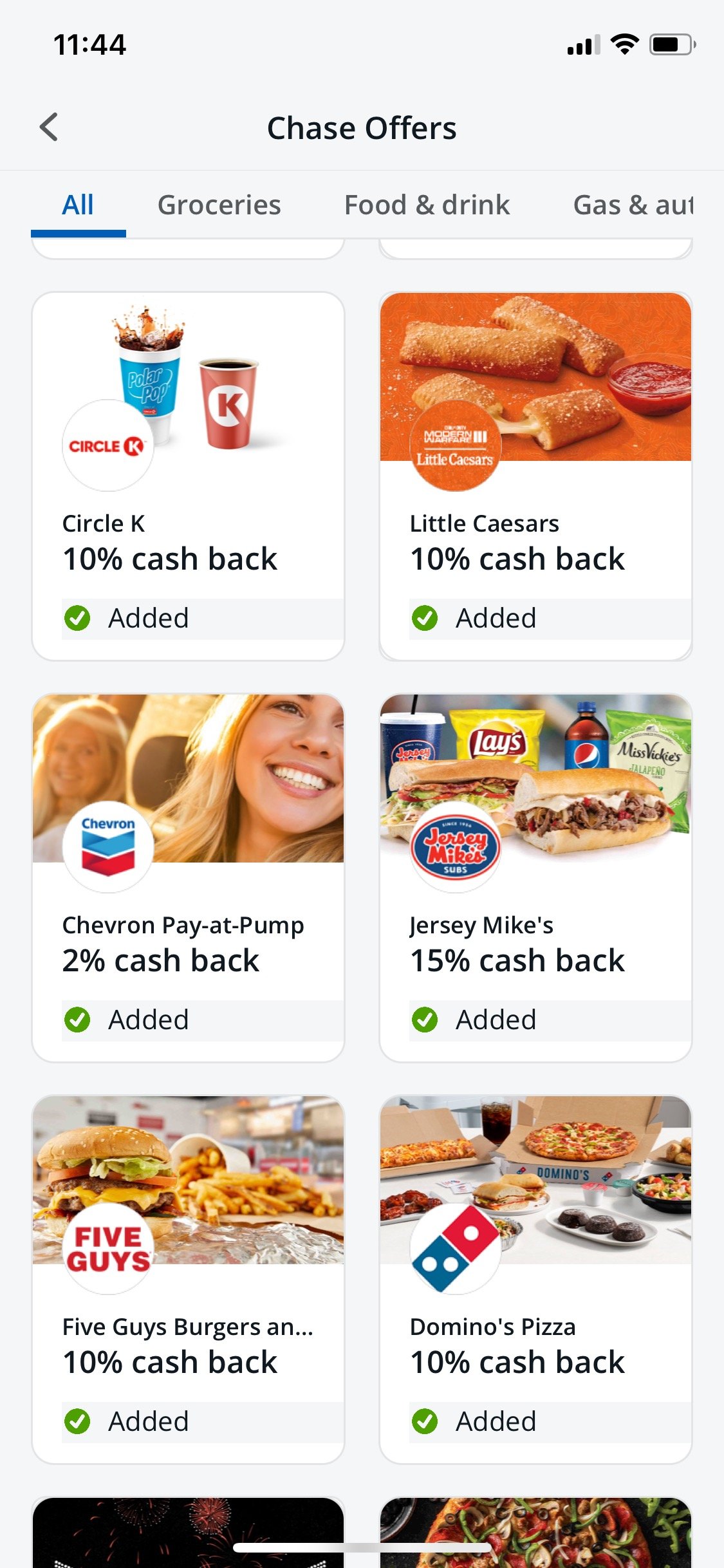

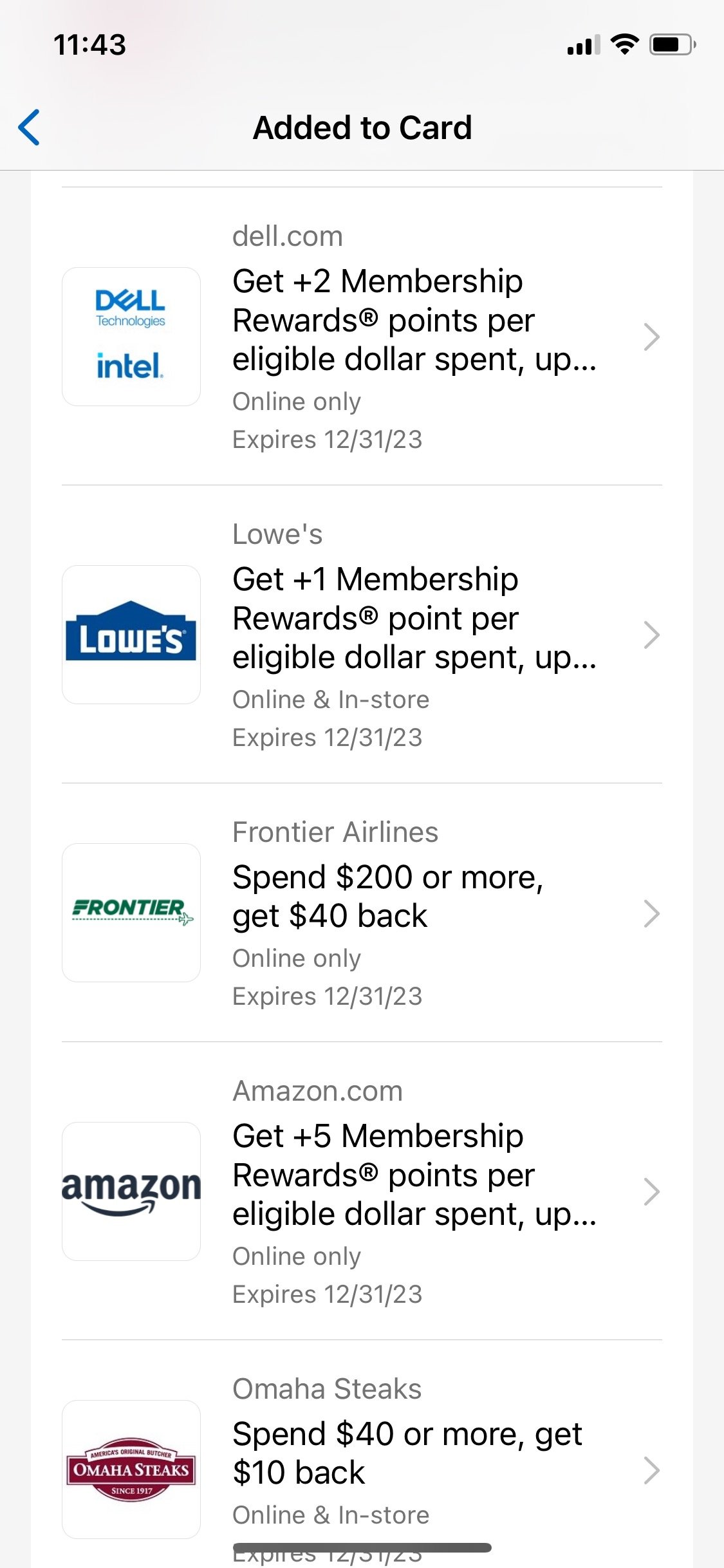

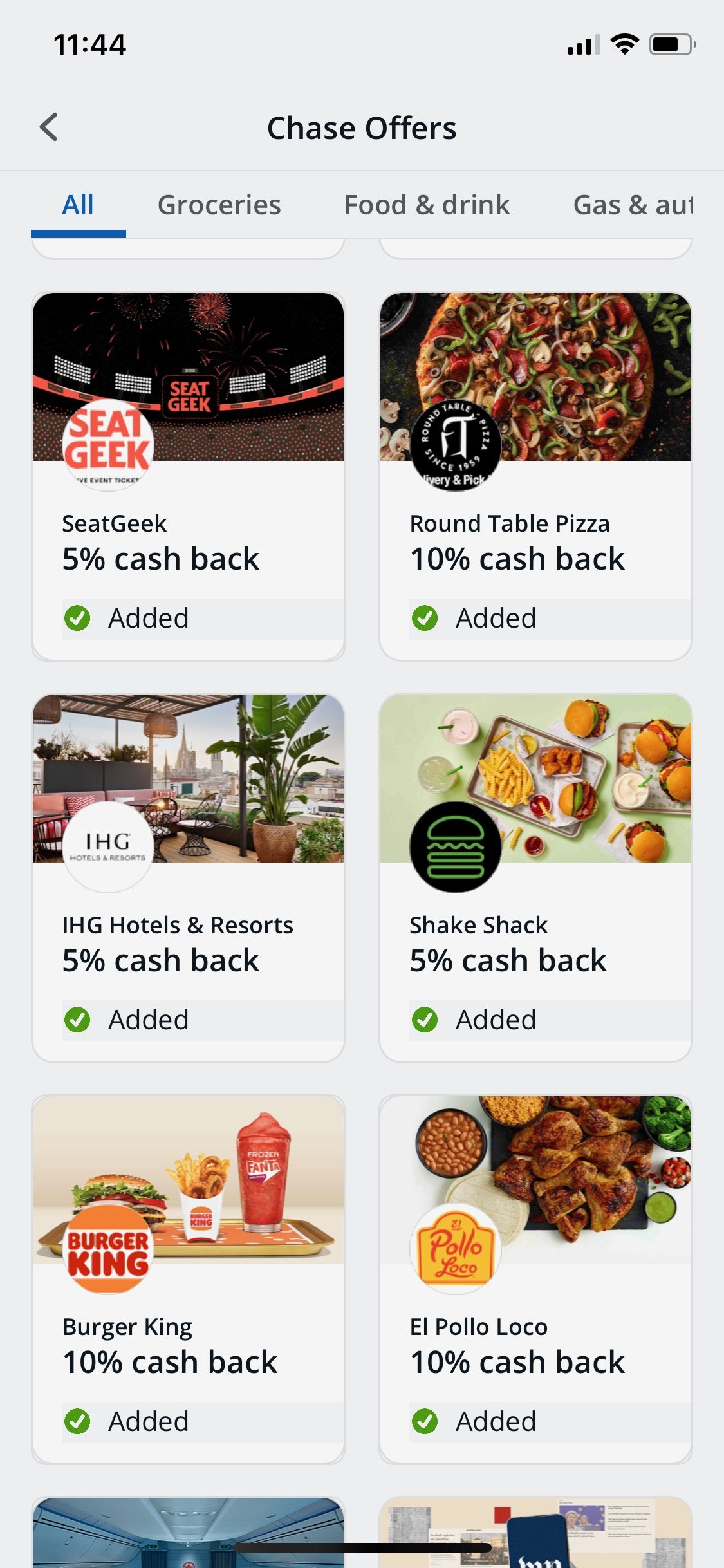

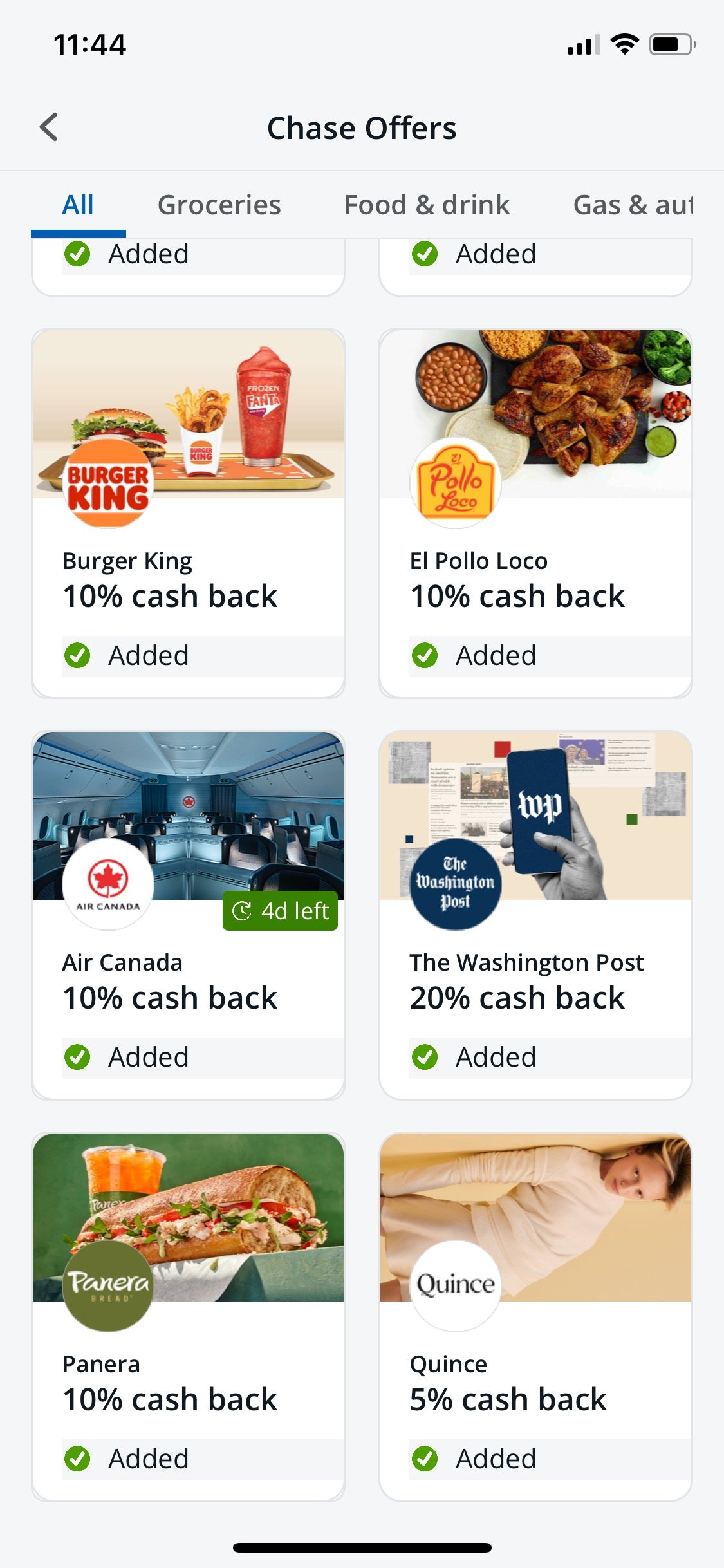

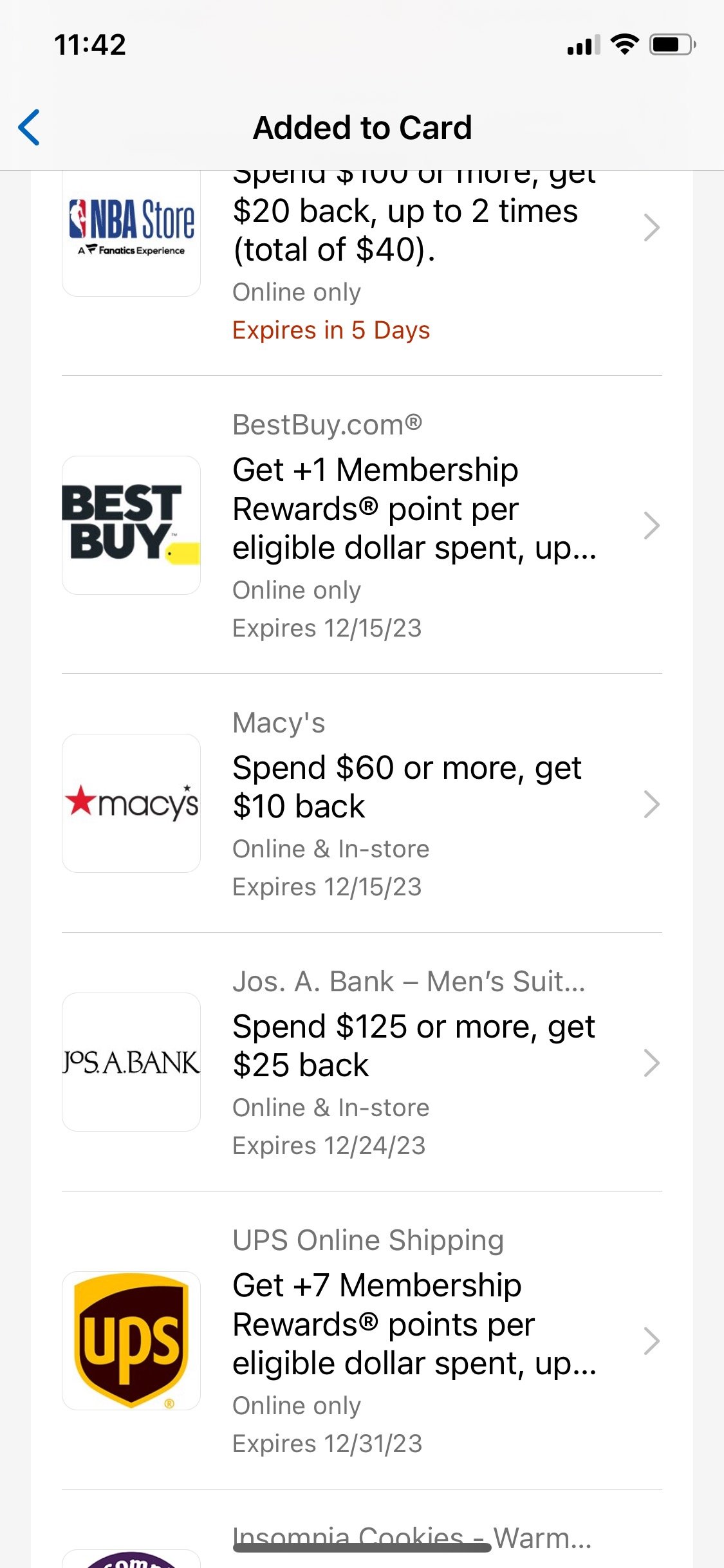

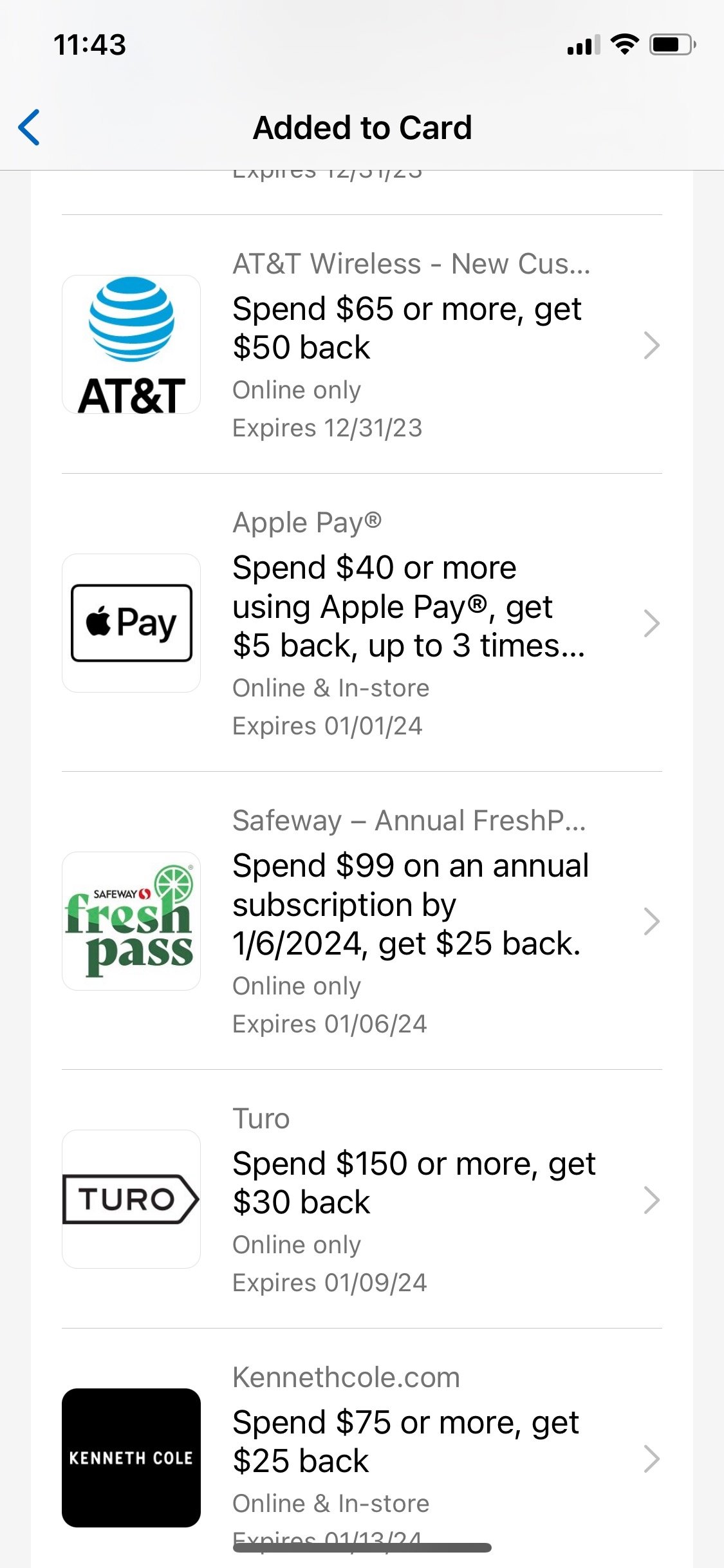

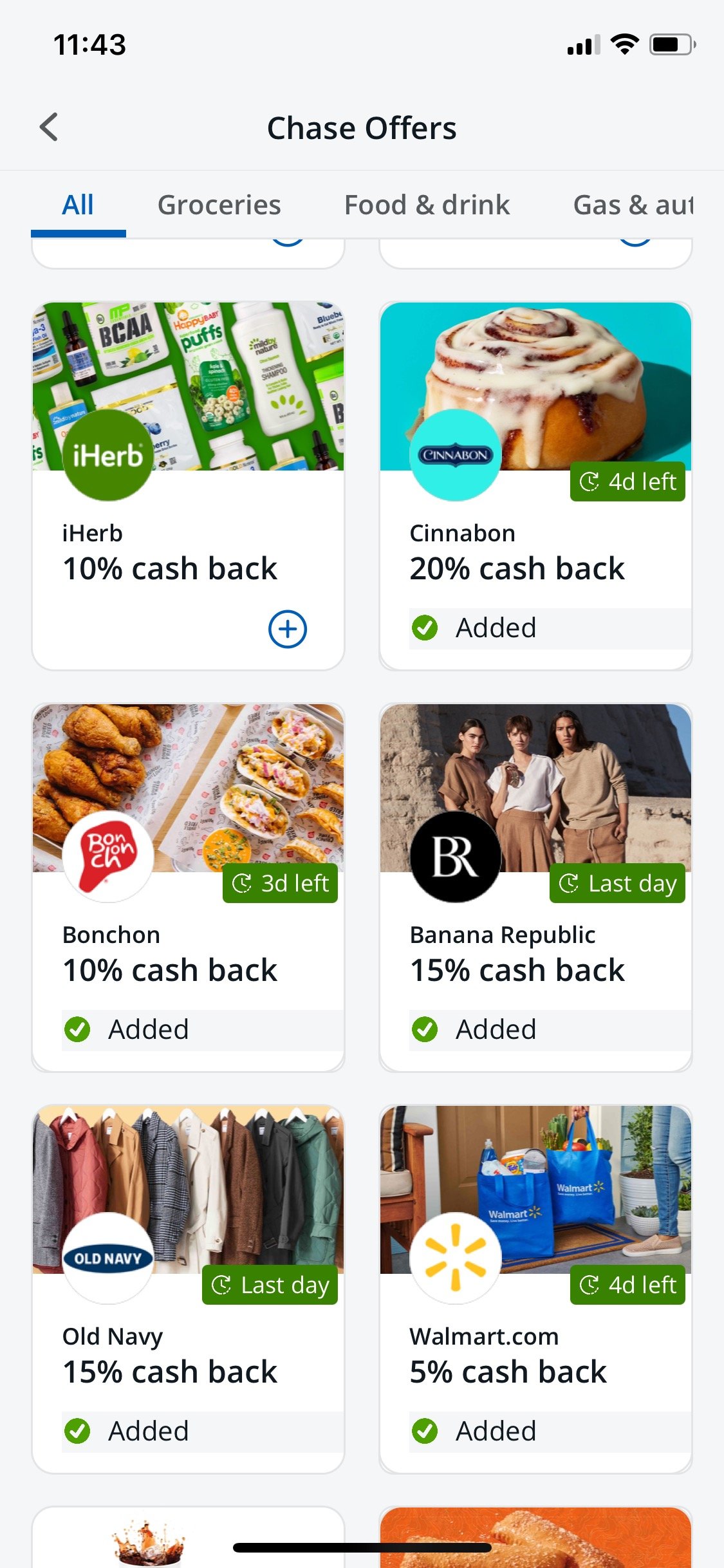

As I write this, I have dozens of offers for savings or extra points at gas stations, major restaurant chains, shopping, hotels, and airfare:

That’s cash back or extra miles at gas stations like Circle K, Chevron, Phillips 66, 76, and ConocoPhillips. 10% cash back or more at Panera, Jersey Mike’s, Burger King, Domino’s, and Little Caesar’s. 5% cash back or more when booking with IHG, most Hilton properties, or when booking any hotel via Expedia (prepaid only) or Delta Travel. If I was in the market for airfare, I could get $40+ back on a $200 purchase with Frontier or JetBlue, or save 10% on an Air Canada flight. Shopping discounts include 5% back or more at Walmart.com, Macy’s, Old Navy and Banana Republic, plus 5 extra points per dollar at Amazon.

I wrote this post in late November, so the deals were slightly better than usual, but not dramatically so. At almost any given time, I have multiple offers on gas, dining, airfare, and hotels available.

A few different ways to approach offers.

Personally, I like the flexibility of having multiple cards to maximize the number of savings opportunities. I also like reviewing my offers to see if there are good deals available on things I’m planning on buying anyway.

The downside of this approach is that you need to keep track of which offer is on which card. A potentially bigger downside is that these are, ultimately, incentives designed to get you to spend money. If you don’t know what the offers are, you won’t be tempted.

To avoid that problem, I like a service called Cardpointers. Although there is a paid version, the free version allows you to simply log into your account and use a browser extension to automatically activate all of the offers available on your card.

This allows you to automatically get any the rewards for any spending you were going to do anyway, without that spending being influenced by the offers. Earlier this year, I had used Cardpointers to add all my Amex Offers. My wife and I went out to eat and, after paying our bill, I was surprised to see Amex was crediting $50 of my restaurant bill back to me:

For the less tech-inclined, you can also activate offers the old-fashioned way. Before learning about Cardpointers, I simply clicked to activate any offer it seemed like I might use when Amex sent them to my inbox. You can also just scroll through the app from time to time and activate all the offers.

Conclusion

Whether you hunt for the best deals across multiple cards or simply use Cardpointers to activate all the deals on your primary card, merchant offers are–at a minimum–a great way to save some money or earn some extra points on your cards. At best, they can expand your options to find a great deal when you have a big expense like a hotel stay coming up.