Save money on hotel stays with merchant offers

Tl;dr: Check the merchant offers on your credit card app before booking; you might save some money.

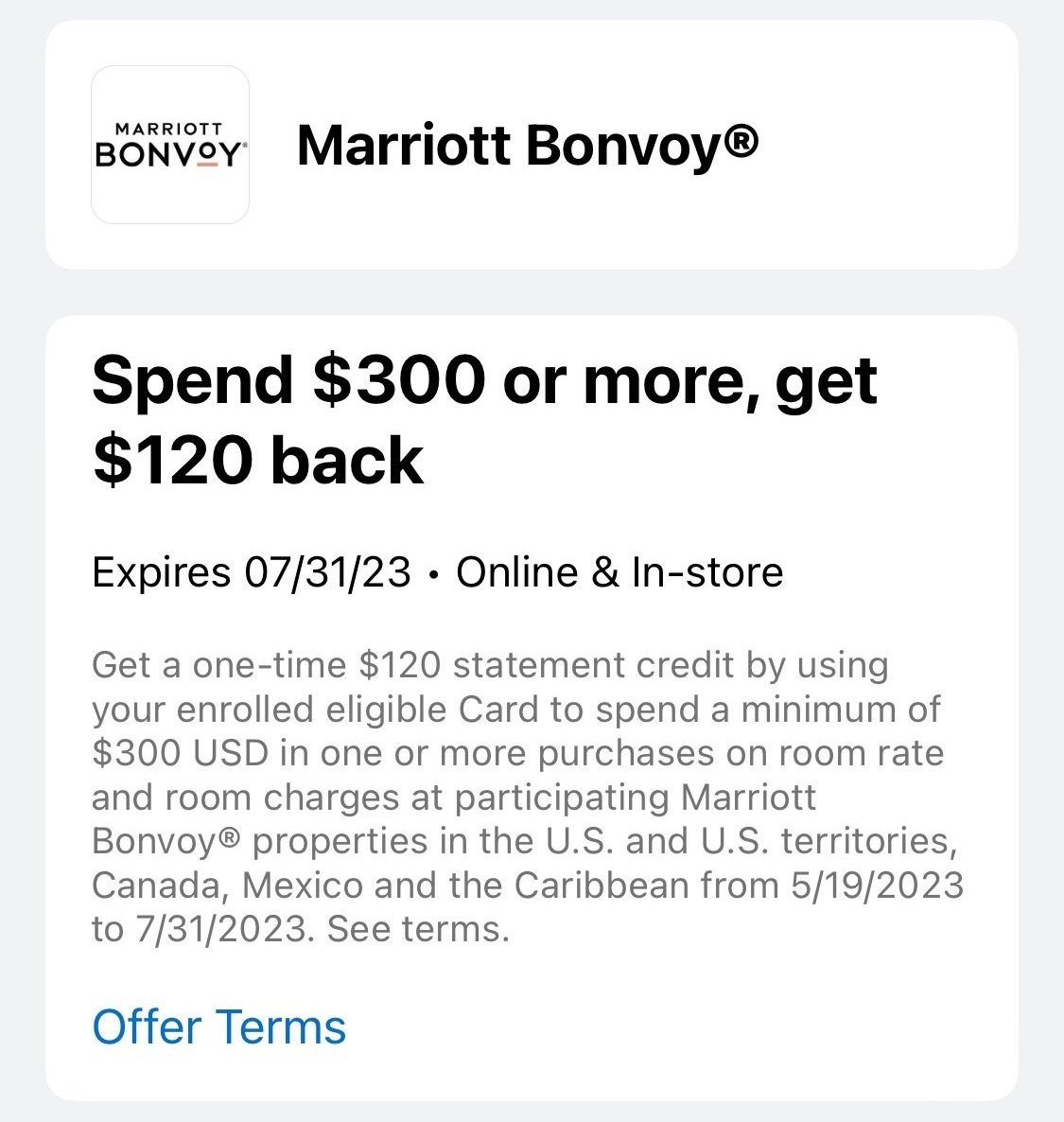

I recently had to book a 2-night stay in DC and, unfortunately, I couldn’t find a suitable hotel for less than about $125 per night. As luck would have it, though, my American Express Gold Card had just released an offer: spend $300 or more at a Marriott property by the end of July and get $120 back as a statement credit.

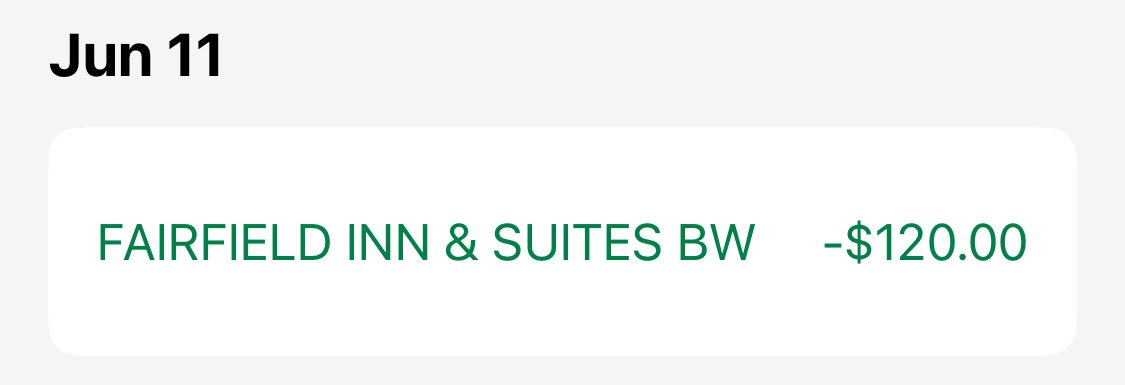

I found a Fairfield Inn for just over $300 for two nights–a fair bit more than I would usually pay, but only $90/night after the statement credit. Shortly after returning home, my Amex bill reflected my credit.

I currently have an Amex Offer with IHG that’s good enough to leave my Premier card in my wallet if the opportunity presented itself, and I’ve recently seen offers from Hilton and upscale hotels like the Mandarin Oriental.

It’s worth being aware of these offers, available with many Amex, Chase, and Citi cards, when looking for the best deal on your next hotel stay. These offers are typically for cash back as a statement credit, but sometimes bonus points or another incentive is offered instead. (Similar AA bonus-mile offers are available with any Mastercard linked to SimplyMiles.)

I recommend checking through these offers when booking, as well as a day or two before checking in, because the deals are usually based on when the spending is charged to your card–you may receive the bonus even if you didn’t know anything about the offer when you booked your room. Be sure to read the terms and conditions–among other things to look out for, your travel may have to be completed by a certain date to be eligible, or the offer may be limited to certain specific locations.

These offers also stack with other benefits. I also received 1 Amex point per dollar for using my card, 1.5 Amex points per dollar via Rakuten (or would have if I had remembered to click through Rakuten for this trip), 10x Marriott points per dollar by booking directly through Marriott, plus 7,500 Marriott points as part of a promotion. If I had Marriott status through a credit card like the Boundless or Amex Platinum, I would have gotten those benefits too.

All told, this is a pretty quick and easy way to cut down on hotel costs while traveling.