Hilton’s Revamped Surpass AMEX Card

Tl;dr: The bonus opportunities are outstanding, the card is decent for regular Hilton customers, but the Hilton Honors program is still not appealing.

Hilton and Amex have gotten together and revamped their higher-tier credit cards, the Surpass and the Aspire. Today, let’s look at the Surpass. Previously, it was a dreadful card, offering fairly trivial benefits that didn’t come close to justifying its annual fee for the average traveler. With the new iteration debuting with a 170,000 bonus point offer, is it time to consider adding the Surpass to your wallet?

It makes sense for Hilton regulars.

The old Surpass card charged a $99 annual fee but only rewarded cardholders with a free night’s stay after spending $15,000 on the card. It came with Hilton’s Gold status (good for free breakfast, among other things) and earned 30 points per dollar on Hilton stays. It also offered 10 free priority pass visits per year, although with unlimited visits being available on other, better cards like the Venture X, the card’s perks didn’t come close to justifying the fee for the average user, even those who booked a few Hilton stays each year.

The new version now sports a $150 annual fee, but with a $50 statement credit for Hilton stays every three months, meaning that the fee pays for itself with three (well-timed) Hilton stays each year; and you come out ahead with a fourth. Although that’s the only benefit really worth mentioning, any card that pays for its own annual fee while offering a perk like Hilton Gold status can be worthwhile. It may make some sense for those who frequent Hilton properties, but not enough to earn Gold status organically, and don’t want to pay hefty annual fees for other cards offering status like the Amex Platinum ($695, Gold status) or Aspire ($550, Diamond status).

Other hotel cards are better, though.

While the card makes some sense for certain Hilton loyalists, it’s not a useful club-in-the-bag card. You have to book at least three Hilton stays, in at least three different quarters of the year, just to break even. And that assumes that you would have booked the Hilton anyway. If you find yourself paying more for a Hampton Inn to take advantage of the credit when there was a Marriott across the street that was cheaper, then that $50 statement credit isn’t even worth the full $50. If you would otherwise be a free agent, the Surpass constrains your choices while likely ending up as a breakeven card at best.

By contrast, the best hotel cards give you a free night to use each year, status perks and high earning rates when you book with that hotel chain, and perhaps some side benefits as well. This allows you to use the full range of possible hotel-booking hacks to find the best deal.

My IHG Premier leads me to book IHG properties often because I get nice perks and big rewards. But I never have to choose IHG over a better deal elsewhere, because it doesn’t cost me anything to leave my IHG Premier in my wallet. By contrast, if I had the Surpass, I would feel pressured to use it before the quarterly credit expired, even though that might not leave me with the best deal overall. This is not conducive to laziness.

And Hilton’s program isn’t very good.

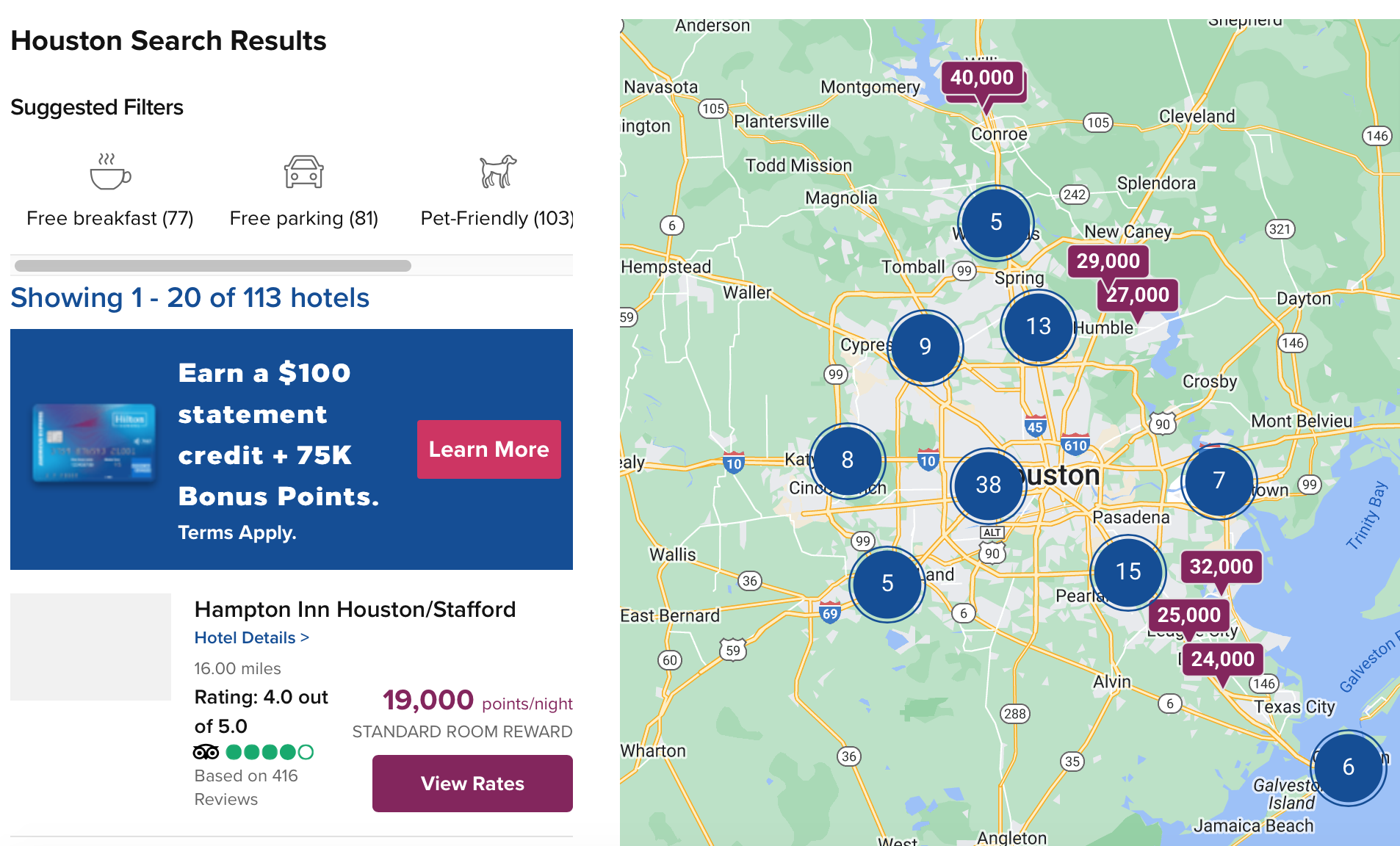

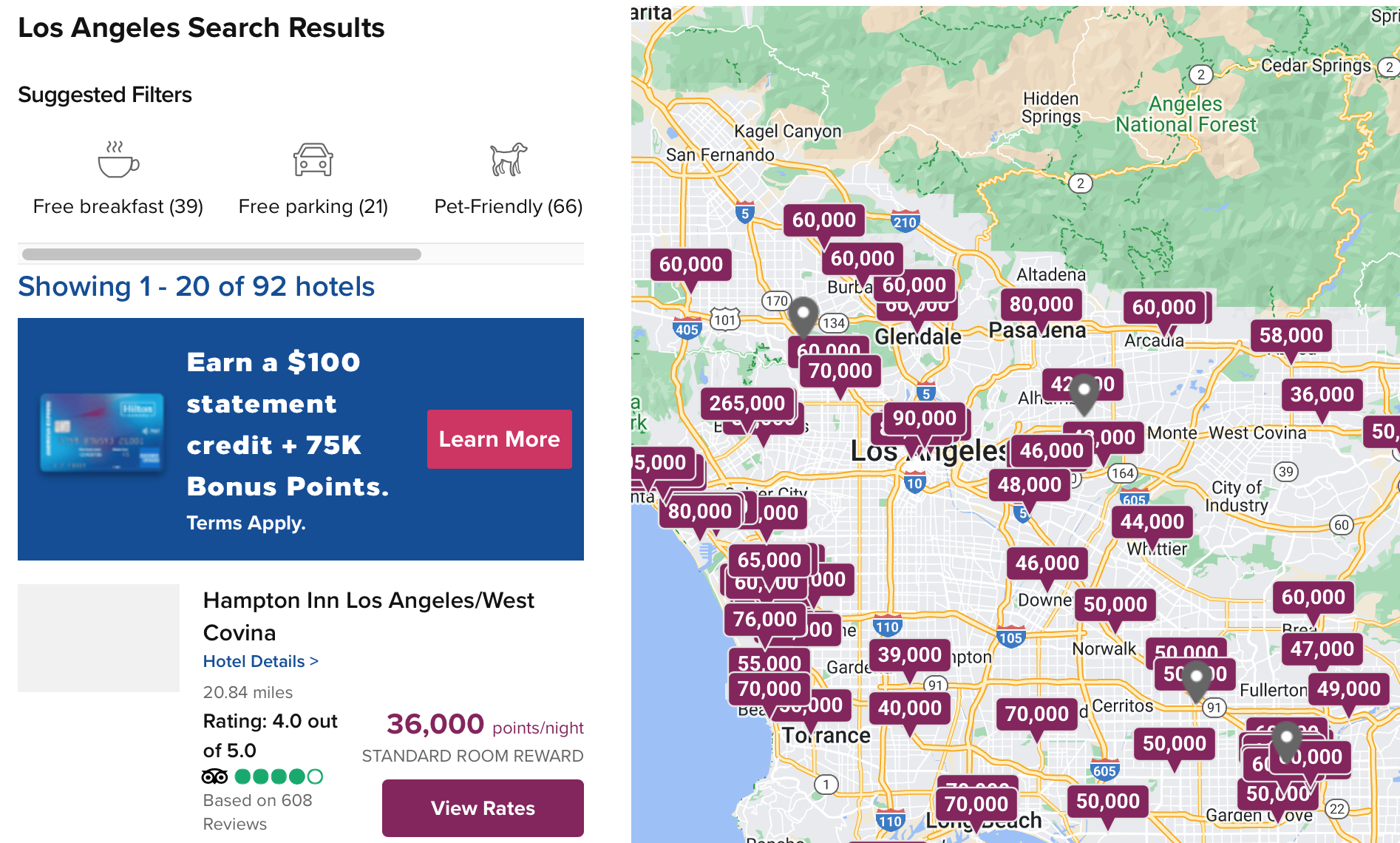

And I doubt I would want to use the Surpass. I tend to book Hiltons when I can find a great deal with a third party booking site like HotelSlash. I find that with Marriott or IHG properties, it usually makes the most sense to book directly, as the combination of points, promotions, and shopping portal savings outweighs whatever slightly lower face price you might get when booking through a different platform. But not so with Hilton. Even if I was earning 30 Hilton points per dollar spent with the Surpass, I’d still have a hard time convincing myself that it’s better to have Hilton points than cash savings given how high the redemption rates usually are for Hilton hotels.

But…

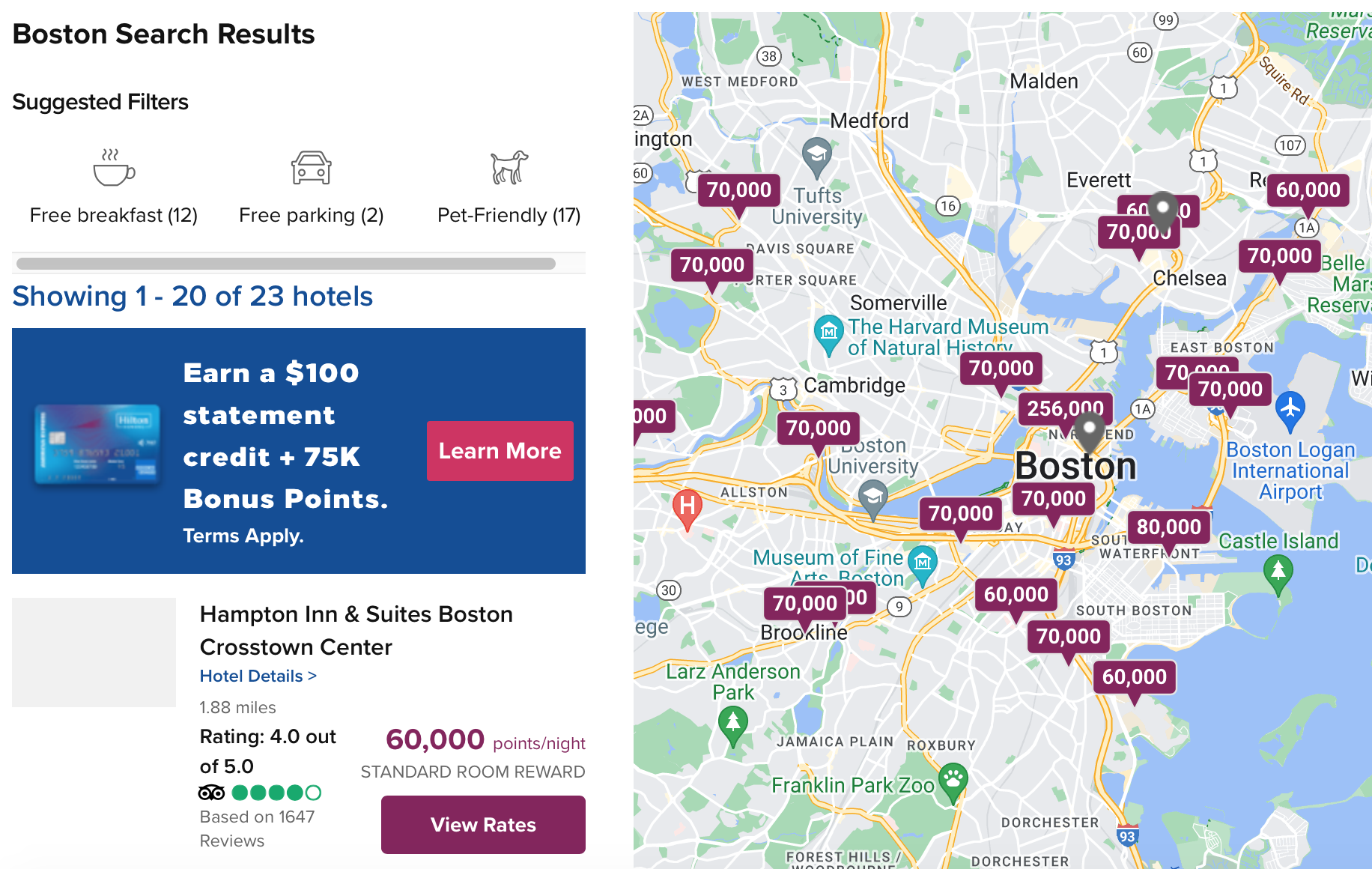

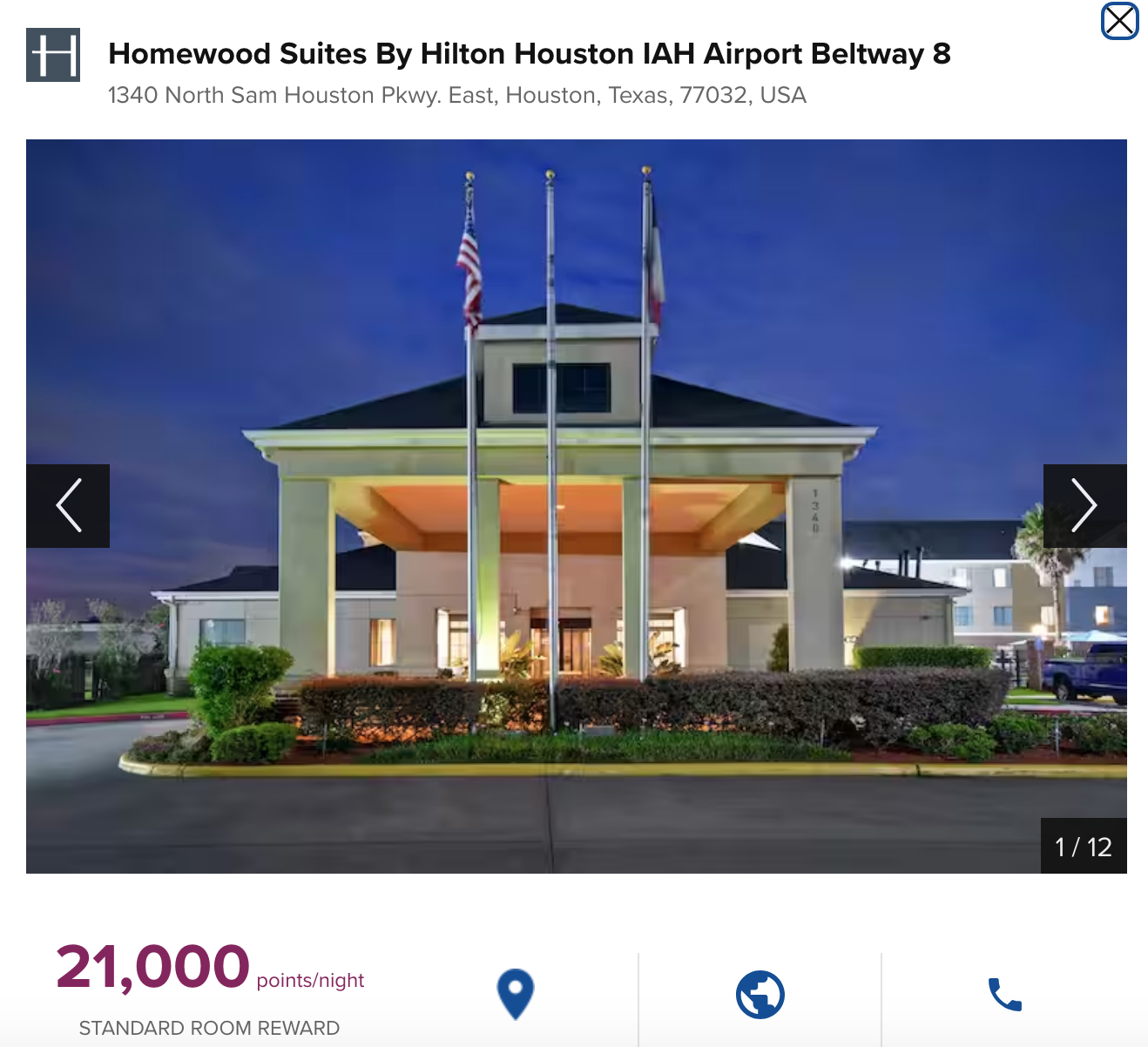

That 170,000 point offer is still good. Really good. Nerdwallet estimates that Hilton points are the least valuable out there, worth about 0.5¢ each, and I agree. But even at that paltry rate, the offer on this card is worth about $850 worth of Hilton hotel stays, whether that’s two nights at the Conrad in downtown Manhattan or a week at a Homewood Suites in Houston.

Combined with the chance to get $100-200 of the fee back in statement credits after a few stays, this may be a worthwhile addition, especially if you have some upcoming travel planned. If you don't find yourself staying in Hiltons often enough to justify the fee, you can always try to downgrade the card to the no-fee Hilton Honors card.

Conclusion

Hilton regulars may want to jump at the chance to get Gold benefits and up to $200 back each year on their Hilton stays. Even non-regulars may want to jump at the chance for 170,000 Hilton points, a sum big enough to be highly valuable even with Hilton’s lackluster points.