Alaska Airlines Visa Signature Review

Tl;dr: This is a great card for regular Alaska Airlines customers, and a great opportunity for nearly anyone to fly internationally.

We here at LazyPoints really like flying to Japan for free. We’ve only done it once so far, but we’re itching for #2. And, conveniently, here comes Alaska Airlines with a credit card offer that would allow us (or you!) to do just that. Alaska’s Visa Signature card is currently offering a 70k point sign up bonus, good enough for a free flight to Japan from many airports. It’s a great card to boot, although most of its perks apply, logically, when flying with Alaska. Although heavily concentrated in the Western US, Alaska is one of the flying public’s favorite airlines, and I’ve been a very satisfied customer whenever I’ve ended up on their planes. So whether you just want to get overseas or are looking to improve your flying experience on Alaska Airlines flights, this co-branded card might be worth picking up.

What’s so great about it?

Standard Benefits

Like most airline credit cards at this tier, holding the Alaska Airlines Visa Signature will get you priority-ish boarding, a free checked bag when you travel, and a discount (20% in this case) on in-flight purchases.

As I wrote in my review of Delta’s equivalent card, I’m not a fan of early boarding, but if you want to avoid involuntary gate checking of your bag, the priority boarding can be a useful benefit. The checked bag benefit is great as well to save money if you’re the type to check bags, and is a great way to save on ski trips, especially considering Alaska offers free lift tickets to certain resorts when you fly with them. And, like Delta, Alaska promises quick baggage delivery to the carousel and backs it up. Also like Delta, the 20% in-flight discount is an underrated benefit, because the food on Alaska flights is delicious–usually both better and cheaper than what you can get in the airport.

Unique benefits

While most airline cards offer pitiful rewards on spend, the Alaska card is actually quite solid in this regard, offering 3x points on purchases with the airline and 2x on a wide variety of categories: gas, EV charging station, local transit, rideshare, cable, and select streaming services. Because Alaska miles are both very valuable and very hard to earn (having no credit card transfer partners), the card will be the best option in your wallet or close to it for most of those bonus categories unless you have a very diverse set of cards.

The earning rates also get even better if you are (or become) a Bank of America customer, as eligible account holders earn an extra 10% bonus on all mileage earned.

Once you spend $6,000 in a given year, you’ll also unlock a companion fare: the ability to fly with a companion for just $99 (plus taxes and fees starting at $23) beyond what you paid for your seat. For expensive long-haul journeys, this could be a very valuable benefit. For example, rather than paying $1000 for two $500 tickets from Seattle to DC, you could pay $623: $500 for your ticket and $123 for your traveling companion. However, unless you’re regularly taking expensive two-person trips on Alaska, it might be hard to derive significant value from this perk.

That said, you could also use the companion fare to book a comfort seat to give yourself a little more space. While this might not have as much value, it could be a nice perk if you end up unlocking the companion fare but don’t have a two-person flight to use it on.

There’s also a $100 discount on Alaska Lounge membership, although this will make sense for very few people (especially because you can access the Alaska Lounge with the AA Executive Club card for about the same price, with several hundred dollars worth of offsetting statement credits).

What are the drawbacks?

The main downside of the card is the annual fee: $95, which, unlike most of its competitors, is not waived in the first year. Whether it is worth that long-term will depend on how much baggage you check and whether you can earn and take advantage of the companion fare. Alaska does not offer a no-fee credit card, so downgrading won’t be an option; you’ll either need to keep paying the fee or cancel altogether.

The card does not mention any travel protections in its advertising (a curious choice), but as a Visa Signature it should have that excellent suite of protections, including baggage loss/delay and trip delay/cancellation insurance.

Is it Lazy?

Yes! The only thing you’ll need to keep track of is the $6,000 you’ll need to spend if you want to earn the companion fare. For my travel habits I doubt I would use the companion fare most years, so I probably would not even worry about this. But if it’s important to you, the spending minimum is a fairly easy and straightforward thing to track.

Earning on the card is also quite lazy. It earns double points on cable, streaming, and rideshare, and 3x at Alaska, all things which you can set up once then forget about. It should be pretty easy to remember to use it if it’s your best card for fuel purchases or EV charging. You’ll have to remember to use it for local transit if you don’t have recurring payments set up (e.g. a monthly transit pass), but that’s not too hard and not many points are at stake there for most people anyway.

How’s the sign-up bonus?

The typical offer seems to be about 60,000, but if you are a Mileage Plan member you can expect to receive a 70k offer in your inbox (or mailbox) every few months or so. The current offer of 70k plus a companion fare in the first year (after spending $3,000 in the first 90 days) is an excellent deal, and enough to book a flight to, for example, Japan:

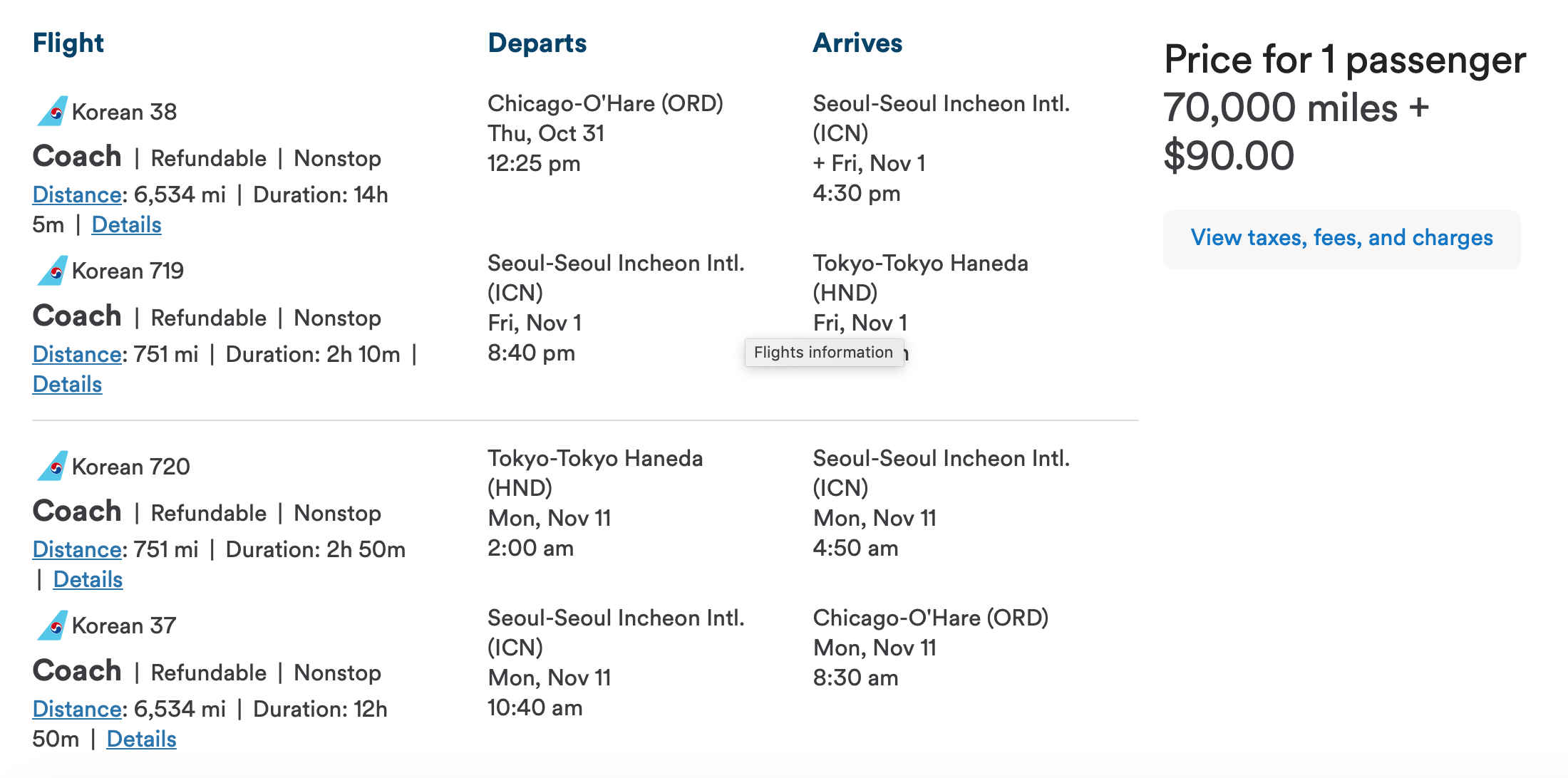

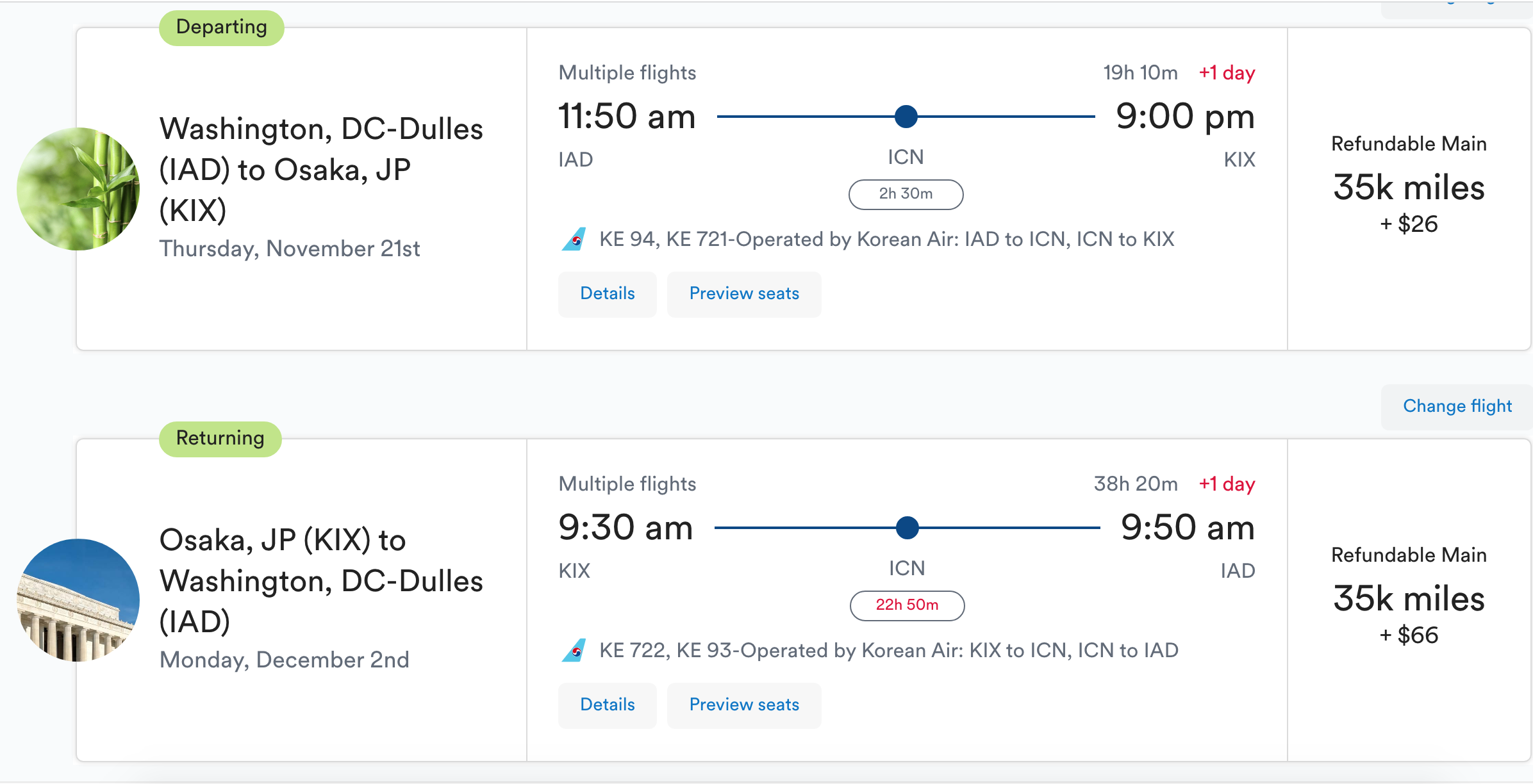

Right now, I can book a flight to Tokyo for 70k miles (the exact amount of the welcome bonus!) and under $100 in taxes and fees.

The best cash deals currently available to Japan are around $900, which is if you choose the cheapest available dates and fly basic economy. A full economy ticket with reasonably desirable dates will run at least $1,200. That translates to a point value of 1.15¢ per point or 1.6¢ per point with conservative calculations. Buying this exact Japan Airlines flight would cost $2,374, for a value of 3.3¢ per point using the face value method favored by many points and miles sites.

Alaska’s partner redemptions will be adjusted in March, so this itinerary would likely jump to around 75k points, and east coast departure airports might get hit harder. Nonetheless, for now, Alaska miles remain highly valuable, and this card is the easiest way to earn them.

Conclusion

The stellar sign-up bonus makes this an easy way to book an international trip on the cheap. The card’s in-flight benefits are a great excuse to experience Alaska’s excellent service, and its solid earning rates on several bonus categories make it a great way to build up your stash of these valuable points. Even if you don’t plan to hold it long-term, the Alaska Airlines Visa Signature card would probably be a great addition to your wallet while this promotion is running. But while the deal is excellent, it comes around fairly often, so I would say you shouldn’t feel any pressure to open the card right now if it doesn’t fit into your credit card plan.

Key Card Details

Annual fee: $95 (not waived in Year 1)

Credits/offsets: Companion Fare after spending $6,000

Earning rates:

3x on Alaska

2x on eligible gas, EV charging station, local transit, rideshare, cable, and select streaming services purchases.

1x otherwise

Protections:

Visa Signature benefits

Perks:

•Priority boarding,

•20% off in-flight purchases

•1 free checked bag for you and up to 6 companions on the same reservation,

•10% points bonus with an eligible Bank of America account