AA’s Great New Credit Card Offer

Tl;dr: 70k miles for $100 - good enough for a flight to Japan from many airports

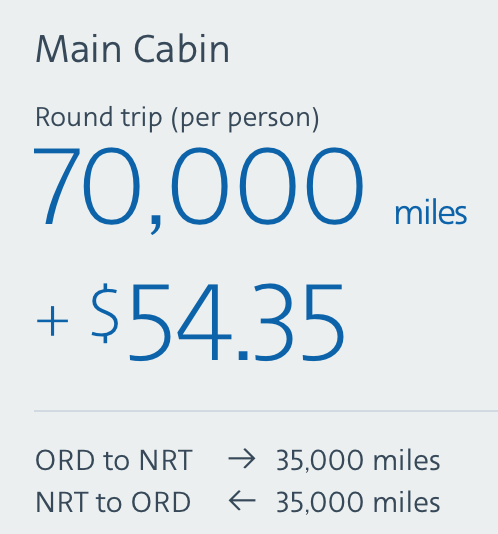

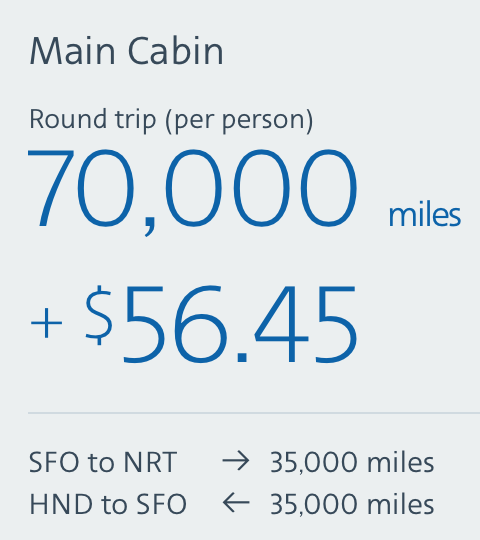

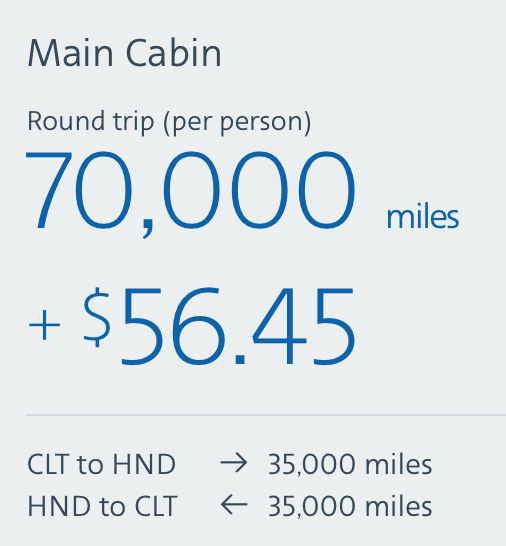

A few months ago, Shawn and I each got the AA Aviator Red card. The main draw was the bonus: 60,000 AA miles, added to your account after making just a single purchase of any size. The annual fee was waived for the first year too. So we signed up, bought a bubble tea, and then booked a nonstop, roundtrip flight to Japan for 70k miles plus about $50 in taxes and fees. We already had some miles in the bank, added some via AAdvantage dining, and filled in the rest with transfers from Bilt.

The 60k promotion ended, and the offer went down to its usual 50k. But Barclays is back in a big way with a 70k bonus offer. Unlike when we got our cards, new cardholders will have to actually pay the $99 annual fee, but there’s still no spending requirement to unlock those miles–a single purchase will do the trick. Because AA miles are generally worth more than 1¢ each, those 10k extra miles are probably worth the $99. Especially because 70k miles seems to be the sweet spot to go to Japan, and this way you don’t need to scrounge around for some extra miles to book that trip. (Of course, you could do any number of things with those miles, including probably flying to Europe, but I point to Japan because those flights seem to be consistently available and represent great value because it’s very difficult to find those flights for under $1,000 in cash.)

Okay, but say you jump on this offer and snag the points and take that dream trip at a ludicrous discount. Now what have you got in your wallet? The answer, in this case, is a huge “it depends.”

If you fly American Airlines with some regularity, it can be a very useful card to have in the wallet. Cardholders get a free checked bag as well as “priority” boarding. The latter is actually boarding group 5 of 9, which isn’t spectacular, but should ensure your carry-on won’t be involuntary gate-checked if you’re worried about that. And these benefits apply to up to 4 traveling companions on the same reservation. You also get 25% off in-flight purchases and a $25 statement credit for purchases of in-flight wifi (AA wifi is often obscenely expensive, and the one time I tried to buy access it wouldn’t work).

So it can be a valuable card to hold. Personally, I’m loathe to pay $99 annually for those benefits, because that I know I would never pay to check a bag and I actually prefer to board last (who wants to spend more time on a plane?). I’m just fine watching TV on my Kindle and would never pay to drink on a plane. That said, since I happen to have it already, I’ve gotten a lot of use from the checked bag benefit, which is especially nice if you’re a skier. For a family of 4 that takes a ski vacation on an American flight each year, the annual fee would pay for itself several times over. And although I haven’t tried American’s in-flight food yet, I’ve recently come to believe that Delta and United’s snack boxes and sandwiches are probably better value than most things you can buy in a terminal.

What it is not is a good card to use. The card offers 2 miles per dollar spent on purchase with American, and 1 mile per dollar on all other purchases. That’s a lousy return compared to strong general-spend cards like the Capital One Venture X and terrible compared to cards with strong bonus categories like the American Express Gold Card. Of course, neither of those cards earn AA miles. But the Bilt card does, and at a higher rate on hotels, cruises, rental cars, non-AA flights, and dining.

AA even has another credit card with Citi that earns 2x miles on restaurants and gas. The two competing cards from the same airline are a legacy of the AA-US Airways merger. Despite the Citi card’s marginally better earning rates, I actually prefer the Aviator. The baggage, boarding, and in-flight food and beverage benefits are the same for both cards, and the slightly better earning rates on the Citi card are still far inferior to many other cards you could use. Meanwhile, the Aviator’s $25 wi-fi discount might actually come in handy. Both cards also offer a benefit after spending $20,000. The Citi card will give you a $125 flight discount, while the Aviator Red will allow you to book a companion on the same flight for $99 plus taxes and fees, a benefit which will be much more valuable in most situations (albeit only if you have someone to fly with).

If you’re a frequent AA flyer, both AA cards can help you unlock elite status with the airline. TPG has a good explanation of AA’s program. Each mile earned with an AA credit card also earns a “Loyalty Point,” and you can earn some minor perks like “preferred seat” upgrades once you reach 15k Loyalty Points in a year. AA’s lowest elite status, Gold, requires earning 40k Loyalty Points. Using a credit card to work toward that status doesn’t appeal to me (especially since some of the main perks of Gold are the baggage and boarding benefits you get from the card anyway), but for some people in some situations this could make sense.

For most people, though, the main draw will be the incredible welcome bonus, along with the perks that come with holding the card. Those perks might even make it worthwhile to hang on to the card after the first year, especially if you are getting genuine value from the baggage benefit. If not, another benefit of the Aviator Red is that Barclays also offers a no-annual-fee version, the “Aviator.” Barclays may allow you to product change to the Aviator, which will allow you to keep that credit line open (as long as you maintain some minimum activity) and thus maintain your credit score. Personally, I’ve been quite happy with the card, and I’ll be renewing it next year. And I’ll definitely enjoy my trip to Japan.

Key Card Details

Welcome Bonus

Currently 70,000 miles after making a purchase and paying the $99 annual fee within 90 days

Typically 50,000 mile after making a purcharse; annual fee waived for the first year.

If you plan on flying AA soon (before the current offer expires), you may want to wait and see if the cabin crew advertises the card. I have seen them offer a few extra miles (maybe 1,000 or so) when applying with a link or code given out on board. Just make sure that it doesn’t re-route you to the standard offer.

Annual Fee

$99

Credits

$25 in-flight Wi-Fi purchase credit

Earn a $99 (+taxes and fees) domestic companion fare after spending $20k (terms apply)

Earning Rates

2x on AA purchases

1x on all other purchases

Earns AA miles and Loyalty Points

Protections

•No foreign transaction fees

•Travel Accident Insurance

•Trip Cancellation and Interruption coverage

•Baggage Delay Insurance

•Auto Rental Collision Damage Waiver

Perks

•First checked bag free for you and up to 4 traveling companions on the same reservation

•Priority boarding (Main cabin 5) for you and up to 4 traveling companions

•25% statement credit for inflight purchases

•World elite mastercard concierge